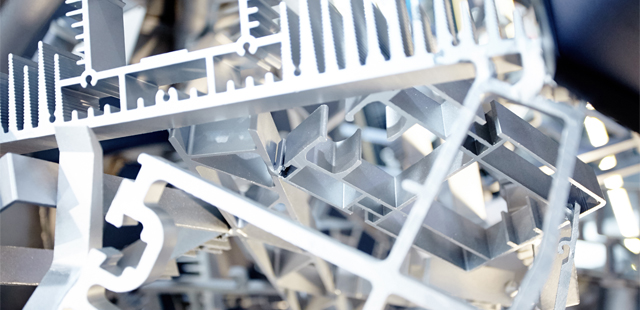

German Aluminium Industry Cautiously Optimistic About Production Growth In 2018

The German association of the aluminium industry (GDA) says the country’s aluminium sector has seen mainly positive developments so far this year. While staying optimistic for the second half of 2018, the association warns of increasing risks due to current political uncertainty.

Aluminium producers reported a production increase of 0.9 per cent and semi producers saw an increase of 0.4 per cent in the first half of the year. Meanwhile, the output from aluminium converters experienced a mild decrease of 1.3 per cent. As a whole, the aluminium market in Germany is expected to stay positive in 2018.

Christian Wellner, GDA’s executive director, commented:

“Despite political uncertainties, the German economy has developed well so far this year. On top of these favourable general conditions, there are the positive economic forecasts for aluminium, which are pointing upwards for nearly all product sectors in Germany and the rest of Europe.”

In the first half of the year, Germany produced around 666,700 tonnes of raw aluminium (comprised of around one third of primary aluminium and two thirds of recycled aluminium) – up 0.9 per cent compared with the same period last year. While production of primary aluminium decreased 1.8 per cent, the production of recycled aluminium increased 2.8 per cent.

Regarding the production of aluminium semis, the industry saw an increase of 0.4 per cent , to 1,251,600 tonnes. This production includes rolled products, extrusions, conductor material and wire for use in the automotive sector, the building and construction industry, mechanical engineering, and the packaging sector. Aluminium rolling mills are responsible for the largest part of this growth. The producers of extrusions also reported a steady situation.

Despite weakening general economic outlook, GDA reports a cautiously optimistic mood in the German aluminium industry with acceptable levels of demand from industrial users and the country’s construction industry.

Andreas Postier, GDA’s head of Economics and Statistics, commented:

“Overall, we don’t see any fundamental signs of an economic downturn in H2 2018 at the moment but, given the increased uncertainty, we’re only expecting a marginal increase in production on average in the sector.”

Further commenting on the uncertainties, he explained:

“The economic risks for the second half of the year have increased markedly: trade disputes, punitive tariffs, problems with the Worldwide Harmonised Light Vehicles Test Procedure (WLTP), etc. On top of this there are the risks associated with the supply of raw materials resulting from the US-Russia sanctions. We’re watching these developments with great concern.”